- Surgical Investing

- Posts

- Trading Pennies For Dollars

Trading Pennies For Dollars

Never overpay for a stock again.

Thanks for reading The Dividend Growth Newsletter!

Today I'll be sharing the importance of valuation.

If you want to join 1,838 other investors learning about dividend investing tactics and analysis, subscribe below:

If you like what you’re reading, please share the newsletter with your friends!

Also, check out my other articles here and find me on Twitter @DrDividend47!

Today’s issue is brought to you by 360 Wall Street!

The hottest stock ideas delivered every morning.

Get the most out of the trading day with 360 Wall Street.

Before the market opens, our experts have already found the 3 stocks they think have the best potential to make the biggest moves – stocks that you’ll see everyone else talking about – tomorrow!

This email is like a little gift 🎁 in your morning inbox, you can get the full details on the top 3 juiciest stocks on our radar - in less than 3 minutes.

Cut through the meaningless news and get right to what is most important!

Over 100,000 people rely on 360 Wall Street to make better-informed decisions.

Best of all... there is absolutely no cost to join!

Click here to start getting the best ideas delivered FREE to your inbox!

Now for today’s piece:

Trading Pennies For Dollars

Highlights

If you only have a few minutes to spare, here are some takeaways about the importance of valuation (trading pennies for dollars):

• Valuation is the most crucial component of market-beating returns.

• The stock market can be wrong and businesses can be bought for less than they’re worth.

• The EV/EBIT multiple can help identify a stock’s intrinsic value.

• Creating a margin of safety can help protect against market downturns and miscalculations.

The Importance of Valuation

As I learn more about the art of value investing, I’ve learned just how truly important valuation is.

In fact, I’m willing to argue that valuation is the most important component of investing.

It helps assure you that you’re paying a fair price for the stock you’re buying.

Valuation is also the most crucial component of market-beating returns. Even suboptimal companies can outperform if investors buy at a low enough valuation. And on the other hand, the best companies can underperform if investors overpay for shares.

Once you realize how to find the true value of a firm, you’ll never want to overpay for shares again.

I know because I overpaid a lot early on in my investing career, but I’m glad I’ve learned to find undervalued stocks.

Because now, buying undervalued stocks feels like trading pennies to buy dollars.

There are numerous valuation strategies that you can use to find the intrinsic value of a stock. My preferred method is the EV/EBIT multiple which I’ll talk more about later.

Whichever valuation method you choose, be sure to buy shares under the intrinsic value you find.

It’ll be the biggest differentiator for your investment returns.

Here’s why:

Creating Returns Through Valuation

The stock market is largely driven by emotion, and that’s reflected in the price of a company’s stock.

The “good” companies are expected to be good forever. Investors don’t expect the price of shares to come down and predict that the company will continue its success for years to come.

The “bad” companies are expected to be terrible forever. Investors become filled with negativity toward the stock and expect the bad times to last forever.

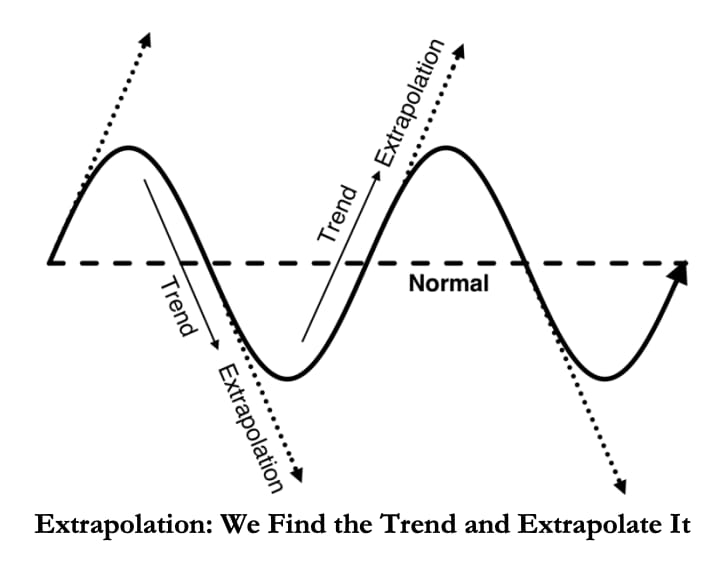

From “The Acquirer’s Multiple” by Tobias Carlisle

But for most companies, the good times don’t last forever and neither do the bad times.

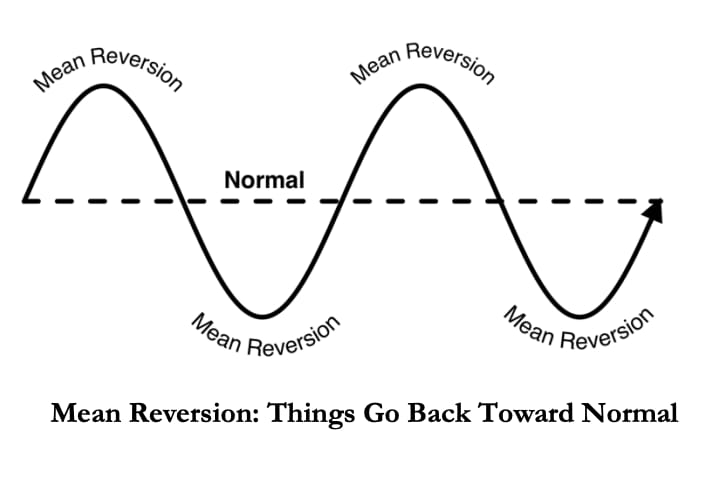

Stock prices go up and down over long periods of time, but they follow the pattern known as Mean Reversion.

From “The Acquirer’s Multiple” by Tobias Carlisle

Mean Reversion is based on the idea that sometimes a stock’s price will go up and down dramatically but over the years, it’ll revert back to the average.

Sometimes, the market will be so excited about a stock and will bid the price up into the stratosphere.

Other times, the market gets it wrong and a stock is trading for way lower than it should.

And there lies the opportunity.

Investors that buy shares of a company below its intrinsic value can take advantage of a few things:

You can buy more shares at a discounted price (which pays out more dividends).

You can lock in a higher starting dividend yield since share prices are lower

You can limit your downside since shares are already cheaper than they should be

You can increase your returns since the stock has more upside to get back to its intrinsic value or higher

Now that you know the benefits of valuation, let’s jump into my favorite valuation metric:

The EV/EBIT Multiple

The EV/EBIT multiple is my favorite valuation metric for a few reasons.

I wrote an extensive article about EV/EBIT that you can view here but here’s a quick breakdown:

EV stands for Enterprise Value (Market Cap + Debt - Cash) and is the true measure of the value of the business in my opinion.

EBIT is Earnings Before Interest & Taxes. EBIT levels the playing field to compare companies across industries and geographies. It assesses the business solely on income generated from operations.

When you take the EV/EBIT from a few competitors and find the average amongst them, you can apply that average EV/EBIT to the firm you’re interested in to find the intrinsic value.

I recently released a video walking through this process to find the intrinsic value of The Home Depot.

Check it out here:

Now that you can find the intrinsic value of a stock, time for the final step:

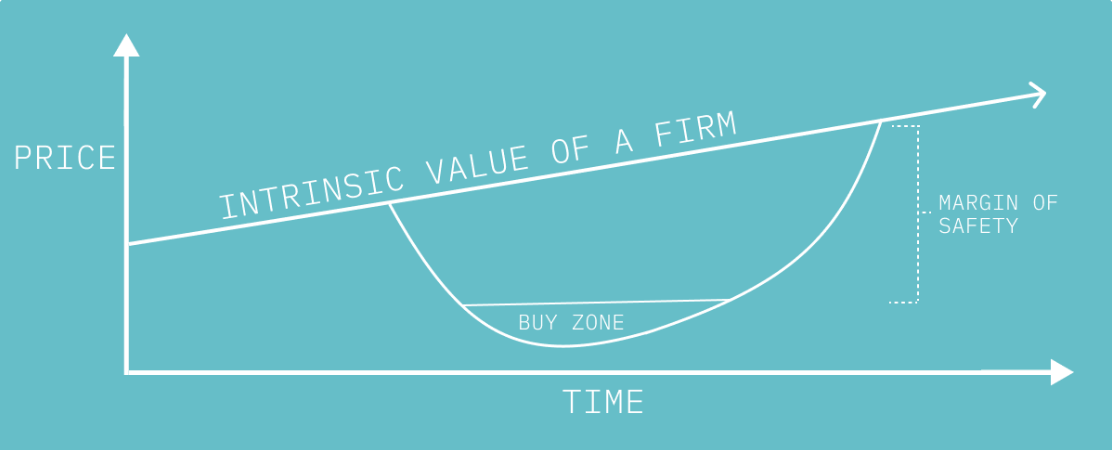

The Importance of a Margin of Safety

A margin of safety is a buffer zone between the intrinsic value you find and the price you pay for shares of a firm.

For an extensive breakdown of creating a margin of safety, you can check out my article here.

For a quick breakdown, here’s how a margin of safety can help you:

A margin of safety protects against unexpected events or market downturns.

It protects against downside risk (the closer you buy to $0, the less downside there is.)

A margin of safety helps protect against any miscalculations or assumptions you make in finding the intrinsic value

For example, let’s say I find the intrinsic value of a stock I’m interested in to be $100. To create a margin of safety, I’d like to buy shares at a 10% discount to that price. 10% cheaper than $100 would be $90 so I’d initiate my position at $90.

But just because I use 10% doesn’t mean you have to.

Your margin of safety could be bigger or smaller depending on how risky you view the investment to be.

If I was investing in something stable like Hormel Foods, I’d likely use a smaller margin of safety than I would for an investment in an up-and-coming tech company.

Final Thoughts

I’d like to close out this article by using a real-world example of why valuation matters.

One of the hottest stocks of the past year has been the semiconductor giant NVIDIA. It has risen 80% in the past year and is trading at a P/E ratio of 179.4x and an EV/EBIT of 138.4x.

That means any investor buying shares today is paying $179.40 for $1 of earnings.

Not a great deal if you ask me.

But that might not even be the worst of it.

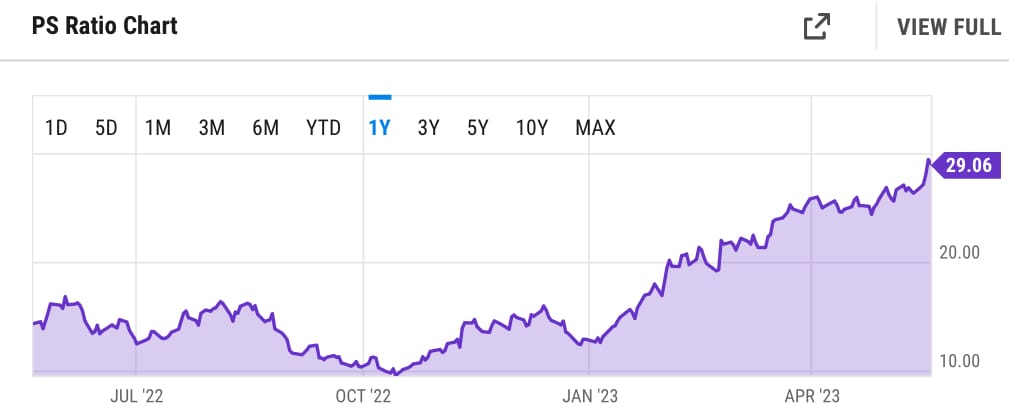

NVIDIA Price to Sales ratio

Today, NVIDIA trades at 29x sales.

For investors buying shares today, it would take NVIDIA 29 years of paying 100% of its sales back to investors in order for them to recoup their investments.

This is assuming:

NVIDIA maintains these revenue levels

There is no cost of goods sold

There are no workers to pay

There are no taxes to pay

And every single penny of sales is paid to shareholders

All of these conditions are extremely unlikely to happen, and shareholders buying shares for the long term today will be disappointed with their future returns.

Valuation matters, it gives investors a fair price to buy shares and is the biggest contributor to market outperformance.

Use it to find the intrinsic value of stocks you want to buy.

Happy Dividend Investing!

Dr. “Valuation Matters” Dividend

Links & Memes

Here are some of the best things I saw this week:

A conversation between Value Stock Geek and concentrated microcap investor Trey Henninger – The man owns 5 stocks, talk about conviction! I loved hearing about his investment strategy which is so different from mine. (VSG)

A breakdown of the business and future of LVMH – The more I read about this company the more I want to own it. I’m fascinated by the way this business operates and Mario from The Generalist absolutely knocks this article out of the park. (The Generalist)

Here are some of my favorite memes from the week:

Incredible analysis of the “fast and furious” film titles (and how they is no underlying logic): tiktok.com/@fredasquith/v…

(h/t @lennysan)

— Trung Phan (@TrungTPhan)

9:54 PM • May 18, 2023

New Episode Of The Dose Of Dividends Podcast!

This week I sat down with Mike, a 42-year-old financially independent dividend growth investor from Canada!

You may know him as @thedividendguy on Twitter.

Mike and I chat about:

How he started investing

His background as an underwriter

The crazy leap he took to becoming an investor

How he became "The Dividend Guy"

What he looks for in an investment

Why people should consider investing in Canada

Industries we won't invest in

Our favorite pizza toppings

Places we've traveled

Books we swear by

Let me know what you think of this episode!

If you loved it, please rank it 5 stars! It goes a long way and means a lot to me :)

Interested in advertising with Dr. Dividend and The Dividend Growth Newsletter?

You can fill out this form to get your product at the top of the newsletter and into the hands of over 1,800 dividend investors!

Reply