- Surgical Investing

- Posts

- Air Products & Chemicals: The Gas Company That’s Building A Green Future

Air Products & Chemicals: The Gas Company That’s Building A Green Future

You might not have heard of this company, but if they didn’t exist, the world as we know it wouldn’t either.

Thanks for subscribing to my Financial Freedom Newsletter!

Today we’ll be taking a deep dive into the company Air Products & Chemicals (APD). APD is a Dividend Aristocrat and is certainly worth analyzing.

Also, I’ll be adding a “tweet of the week” section where I’ll highlight something funny or insightful. Let me know if you like it!

If you like these issues, be sure to tell a friend! It really helps grow the newsletter.

Without further ado, let’s dive in!

________________________________________________________________

Today’s issue is brought to you by Vint!

Wine has been a respected asset since 6,000 B.C. It's one of the most traded commodities in the world, and it outperforms the S&P 500 by 0.1% annually.

Vint offers you fractional shares of high value wines—and now you can diversify your investment portfolio with wine!

Fine Wine is uncorrelated to the stock market and not very susceptible to macroeconomics, making it the perfect tangible asset to diversify your investment portfolio.

At Vint they offer you fractional shares of high value wines so you don't have to go through all the hassle of storing and managing physical bottles yourself!

Get started and diversify your portfolio today!

It’s not complicated like crypto, credit derivatives, or NFTs. Our team curates collections of blue chips and up-and-coming investment-grade wines.

Air Products & Chemicals (APD)

Highlights

APD is a Dividend Aristocrat and has increased dividends for 40 consecutive years

APD is the world’s largest supplier of industrial gases.

It is investing in carbon capture and gasification technologies to fuel future growth and a greener planet

Company Profile

Air Products and Chemicals, Inc. provides atmospheric gases, specialty gases, equipment, and services worldwide. The company produces atmospheric gases, including oxygen, nitrogen, and argon; process gases, such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas; specialty gases; and equipment for the production or processing of gases.

It also designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, and liquid helium and liquid hydrogen transport and storage. The company was founded in 1940 and is headquartered in Allentown, Pennsylvania.

Thesis

Air Products & Chemicals (APD) is the world’s largest supplier of industrial gases such as hydrogen, neon, and helium. Its gases are used in the manufacturing of everything from jet engines to smart phones. APD’s core gas business along with its 3 green business segments (Gasification, Carbon Capture, and Hydrogen) will propel us to a greener future and reward shareholders with growth and handsome dividends.

Recent News

Positives

Contracts

Air Products & Chemicals has many positive tailwinds, the first I’ll focus on is their long-term contracts with customers. Much of its revenue comes from partnerships with customers that involve very complex infrastructures that aren’t easily replicated or easy to switch. These contracts provide consistent, recurring revenue and show potential Investors that they’ll have a steady income stream for years.

Worldwide Presence

Air Products & Chemicals also has a worldwide presence, making the company appealing. They have some notable partnerships in Saudi Arabia, Mongolia, China, Canada, Indonesia, and America. The partnership I'm most excited about is the joint venture with the #1 energy supplier in the world, Saudi Aramco. APD built a carbon-free facility in northwest Saudi Arabia that supplies the oil giant with green hydrogen, power, steam, and utilities. The partnership is for 25 years and $12 billion and will help Aramco pump out 400,000 barrels of crude oil daily from this refinery.

Future Growth Prospects

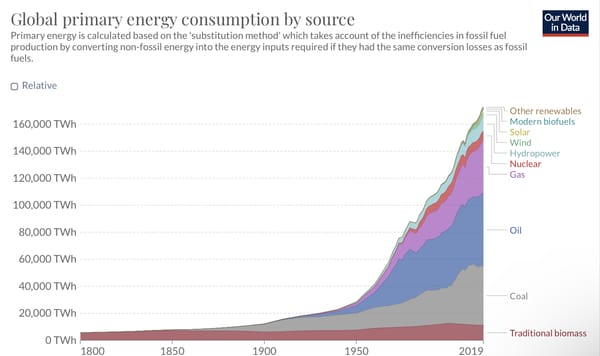

APD has many future growth prospects, one of which is Gasification. Gasification turns waste byproducts of burning fossil fuels like coal into usable synthetic fuel known as Syngas. This Syngas can then be used for many things such as fuel, chemicals or power. This process is immensely useful today especially since coal usage has increased due to the European Energy Crisis. The inability to use Russian oil due to sanctions has left many European nations turning to coal to fulfill energy demand. APD can implement these gasification technologies to not only create Syngas, but to also make the coal usage cleaner.

Carbon capture is also becoming a major segment of APD's business. They use carbon capture for capturing CO₂ from gasification processes to selectively separate H₂S and CO₂ from "shifted" syngas, usually in a physical solvent adsorption process. This simplified process has the potential to offer faster output and lower capital expense. They've invested $4.5B to build, own, and operate the world’s largest blue hydrogen production facility in Louisiana, USA. The mega project will capture over five million metric tons per year of CO₂, making it the largest carbon capture for sequestration facility in the world. It's expected to be fully operational by 2026.

Green Hydrogen is another catalyst for future growth. In addition to providing hydrogen on-site to customers, APD is investing in hydrogen technologies to power our future. APD is partnering with World Energy to build North America’s largest sustainable aviation fuel production facility. It is expected to produce 340 million gallons of sustainable aviation fuel annually. The project includes a new hydrogen plant to be built, owned, and operated by Air Products and renewable fuels manufacturing facilities to be operated by World Energy, as well as an extension and capacity increase of Air Products’ existing hydrogen pipeline network in Southern California. Continuing Air Products’ leadership in driving the energy transition, this U.S. megaproject will provide measurable sustainability benefits and advance California’s decarbonization goals by producing renewable fuel to meet the growing demands of the aviation industry. APD has also stated that they will redesign its fleet of over 72,000 heavy trucks to run on hydrogen fuel cell by 2030.

Profitability

Lastly, APD is a highly profitable company. Earnings Per Share has increased at a CAGR of 11% from 2014-2020, and its high-profit margin of 19.08% and low CapEx sets it up for a profit of $587 million in its latest quarter. It is the most profitable chemical company in the world.

Negatives

Geopolitical Risk

There are some negatives to consider when analyzing Air Products & Chemicals' business, the first of which I'll talk about is their geopolitical risk. While Air Products' worldwide presence is a plus, lots of its business is conducted in areas of high geopolitical risk, such as China and Saudi Arabia. It's something worth watching if political tension starts to heat up, as 57% of APD's 2021 revenue came from countries outside of the US.

Foreign Exchange

Another risk is the change in foreign exchange rates. As previously stated, APD conducts the majority of its business outside of the US. As we've seen recently, the US dollar has shown immense strength, and currencies such as the Euro and Yuan have lost much of their value in 2022. To combat this, APD could raise prices abroad but I'm not sure how much they'll be able to do so.

Worker Shortage

Air Products is also facing a skilled worker shortage. Like many companies during this period of the Great Resignation, Air Products is facing a worker shortage. This labor shortage is driving the cost of wages up in hopes to retain the small number of skilled laborers that are left. Sixty to eighty percent of professionals in the chemicals sector expect labor costs to increase over the next three years, with an average wage hike of 8%-10% anticipated by 2024.

Energy Preferences

The last negative I'll talk about is the change in energy preferences. APD is betting on hydrogen as a major fuel source in the future but as we've seen recently, green energy isn't always favored or attainable. APD also plans to generate future growth through carbon capture and gasification but in the event we become completely renewable in the future (solar, water, wind), there won't be a need for carbon capturing technology. APD looks like they are able to adapt to changes in energy preferences, however many of its projects and technologies are costly and take a lot of time to implement. APD will need to stay ahead of the curve and predict energy demand quickly before starting heavily involved projects.

The Dividend Breakdown

For those that don’t know, I mainly use 3 metrics to assess the quality of a company’s dividend. The first is the Dividend Growth Rate, which I use to assess the company’s ability to raise dividends and combat inflation. When assessing the Dividend Growth Rate, I look at the 10 Year Compound Annual Growth Rate (CAGR) because it’s usually the longest-term data readily available and more indicative of long-term company trends. The second metric I use is the Dividend Payout Ratio, which tells me how much of the company’s profits are going to shareholders. The Dividend Payout Ratio also shows me how much room a company has to grow its dividend before it becomes unstable. The last dividend metric I use is Dividend Yield. Dividend Yield tells me how much “bang for my buck” I get as a shareholder. Yield isn’t everything, but it’s nice to see how much money I’ll get back as an investor in the next quarter.

With that being said, I’ve developed a scoring method for rating a company’s dividends. It consists of the previously mentioned metrics scored out of 5 and each score is multiplied and weighted by importance. The highest possible score a company can receive is a 31, and members of the Dividend Aristocrats club will receive an extra point for their long-standing history of reliable dividend raises. Each metric has its own criteria which I’ll share below:

Dividend Growth Ratio is the most important metric for me, so scores will be multiplied by x3

Dividend Growth Ratio of 0%-5% is a 1, 5%-7% is a 2, 7%-9% is a 3, 9%-12% is a 4 and a rate of more than 12% is a 5

Dividend Payout Ratio is the second most important metric, so scores will be multiplied by x2

Dividend Payout Ratio of 95% or more is a 1, 75%-95% is a 2, 55%-75% is a 3, 35%-55% is a 4 and a rate of less than 35% is a 5

Dividend Yield is the least important metric of the 3, so scores will be multiplied x1

Dividend Yield of 0%-1.5% is a 1, 1.5%-2.5% is a 2, 2.5%-3.5% is a 3, 3.5%-4.5% is a 4 and a rate of more than 4.5% is a 5

APD scores are shown below:

APD’s 10-year Dividend Growth Rate (CAGR) is 10.99%, beating the Materials sector median of 7.50%. Their Dividend Payout Ratio is 62.21%, a little on the higher side but not cause for panic in my opinion. Its dividend yield is 2.55%, a little higher than its 5-year average yield of 2.20%. Compared to the median yield of 4.92% in the Materials sector, APD’s 5-year average yield is low. Lastly, APD has been paying a dividend for 41 years. Overall, APD scored 22/31 points, proving that the company has a decent dividend. It is worth mentioning that APD raised its dividend by 9.86% in 2021, outpacing the 8%+ inflation we've had to deal with.

Final Thoughts

Air Products & Chemicals provides a compelling investment opportunity. It is very profitable, shows years of sustained dividend growth, and is implementing various long-term projects to fuel future growth. The materials sector is often underrepresented but their products are a necessity for our society to function. I love that APD is focused on making our current fossil fuel energy infrastructure greener as well as providing alternative energy solutions in the future. The company has even pledged to reduce carbon emissions by 30% in 2030 and go net-zero by 2050.

I plan to initiate a position at $222.

What do you think about APD? Is it a company you’ll add to your portfolio? Why or why not? Let me know on Twitter @DrDividend47 or in an email to [email protected]!

Tweet Of The Week

This week’s tweet comes at you from my favorite writer & memeologist @TrungTPhan and it had me cracking up 😂. Food for thought, is Eugene Krabs the greatest entrepreneur of all time?

Level Up Your Dividend Investing!

My book, “Time Is Money: How To Dividend Invest & Buy Back Your Time” is available now! The book comes with my Dividend Stocks Checklist ($7 value) absolutely FREE! Use the book to improve your dividend investing with the best strategies, and use the checklist to help weed out junk stocks and streamline your research!

I believe that we all deserve a life of financial freedom and ownership of our time. But if you’re like me, you’ve probably struggled to find a strategy that works. That’s why I wrote this book—to help you buy back your time by investing in dividend-paying companies.

Buy Back Your Time With Dividends!

Helpful Resources Are Here!

Don’t forget to check out my website full of awesome free resources to jumpstart your investing! 👇

Here’s my list of the best resources for financial freedom, enjoy!

Reply